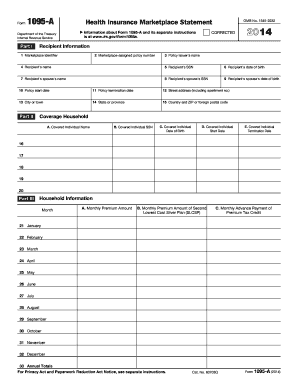

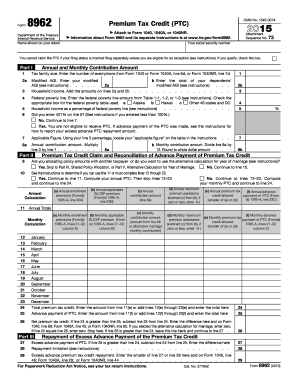

Get the free 10 95 form

Get, Create, Make and Sign

How to edit 10 95 form online

How to fill out 10 95 form

Who needs 10 95?

Video instructions and help with filling out and completing 10 95 form

Instructions and Help about 10 95 form

What's going on YouTube you not a gamer here and welcome to a guide here on Pokémon Sun Andonémoon on horegardedde in this game this is the most long and tedious way to get a legendary that we have seen in all seven generations of Pokémon who gets eye guards a hundred percent form you have to collect five garden cores in 95 garden cells spread out amongst the aloha region I'm going to walk you through step by step on how to get every single core and sell for Wagons a hundred percent form I'm going to be categorizing it by islands you can look in the description below as I will have a timeline of every core that I collect throughout this video if you have any questions be sure to comment below but if you really want my attention be sure to follow me on Twitter and Snapchat at United gamer 101 those are the best ways to contact me if you found this video helpful be sure to give it a thumbs up and subscribe for more Pokémon content on my channel I'm going to be doing another luck of this game really soon do note that I am collecting all of these after defeating the Elite Four and becoming the Aloha Region champion, so I assume you already have the garden cube that you collect through the story mode also notice some of these sales you can only collect during the day and at night so if you don't see the sell there try it at nighttime you can actually change the time of your game by going to the altar of the Moon or alter of the Sun depending on your game and going in the portal, and it will change the time I'm actually going to be making a video on that soon to make it more clear but with all of that being said let's go ahead and get straight in the video we are going to start off with the cells and do the cores later first off in Mexicali island we will have 14 cells coming from your house on to route 1 take a right and come to this back right corner to collect your first cell next coming from the house yet again take it left this time and this one's going to be on route 1 as well follow this path, and you will get your second cell I am going to be speeding these videos up just a little to not take too much of your time so be sure to pause the video if needed to continue on down this path and under the tree you will find your second cell coming from your house, yet again you're going to make your way down by the professor lab to collect your third cell coming from the route 1 Pokémon Center you want to make your way to the trainer school that you visited early in the game you must come here at nighttime to collect this cell but come over at 9:00 time go over to this back right little cushion and grab your next cell starting from the far right of route 2 you want to make your way up to this back left and go in front of the building on the porch and grab your 5th cell this one must be at night as well during the daytime on route 3 outside the Mexicali meadow come down to get your sticks cell coming from the same spot on route 3 outside the Mexicali...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 10 95 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.